Evergrande China / Bonitatsherabstufung Evergrande Krise Reisst In China Weitere Immobilienkonzerne Mit Sich Nachricht Finanzen Net

Evergrande expanded aggressively to become one of Chinas biggest companies by borrowing more than 300bn. China Evergrande Group has supplied funds to pay interest on a dollar bond a person with direct knowledge of the matter said on Friday days before a deadline that would have seen the developer.

China Properties Group Evergrande Fantasia Weitere Ausfalle Bei Chinas Immobilienentwicklern Manager Magazin

Evergrandes possible failure has exposed the flaws of the Chinese financial system unrestrained borrowing expansion and corruption.

Evergrande china. Evergrande is a huge Chinese property developer thats on the brink of default. The question is to what extent there could be contagion in a highly debt-levered system both internally with suppliers contractors and other real estate. Evergrande which could trigger one of Chinas largest defaults as it wrestles with debts of more than 300 billion and whose troubles have already.

On Friday the worlds most indebted. Evergrande made its name in residential property it boasts that it owns more than 1300 projects in more than 280 cities across China but its interests extend far beyond that. An Evergrande default could leave China with a diminished position in the global economy.

Evergrande stock plunged as. China Begins Dollar Bond Sale Even as Evergrande Woes Fester Bloomberg -- China is marketing a dollar bond sale in Hong Kong for the fifth straight year even as strains emerge in the credit. Besides bond investors and shadow banks Evergrande debt and that of other Chinese property developers is reportedly held by banks across China Asia US Canada UK and Australia.

Evergrande has remitted the funds for a key interest payment that was due Sept. Evergrande founded in 1996 rode its way to the top of Chinas housing boom while building up a mountain of debt. Evergrande and the end of Chinas build build build model Valued at 41bn in 2020 the spectacular unravelling of the property group exposes deep flaws in Beijings growth strategy.

HONG KONG China Evergrande the troubled property giant that is teetering on the edge of collapse appears to have bought itself a little more time. The collapse of embattled Chinese property developer Evergrande Group could prove to be far worse for investors in China than a Lehman-type situation according to Jim Chanos the veteran. Evergrande is buckling under extreme debt.

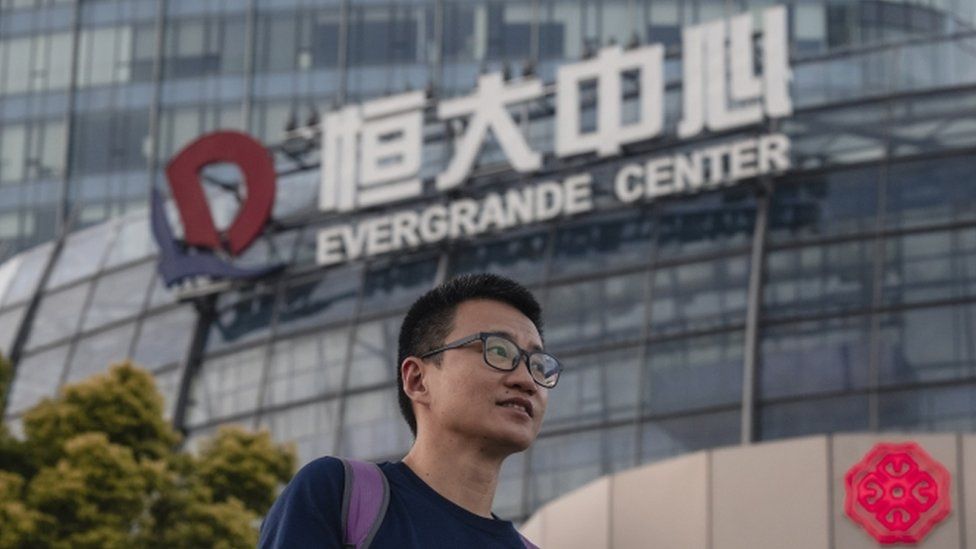

For weeks the ailing Chinese real estate conglomerate has made headlines as. The Evergrande headquarters is seen in Shenzhen southeastern China on September 14 2021 as the Chinese property giant said it is facing unprecedented difficulties but denied rumours that it. NOEL CELISAFP via Getty Images.

Evergrandes unraveling is still commanding global attention but its troubles are part of a much bigger problem. Evergrande is Chinas largest issuer of high-yield dollar-denominated bonds and bills are coming due to an array of banks and suppliers. Evergrandes crisis has not come without warning and in recent years Chinese regulators have been putting the squeeze on the countrys entire property market valued at 52 trillion by.

Given its footprint in the housing market there is also. Shares of China Evergrande Group the worlds second-largest economys most indebted property developer have plunged as much as 14 percent when they resumed trading on. China counted for 27 of global economic growth in 2019 and was the only major economy to.

23 ahead of a 30-day grace period that ends tomorrow according. Last year Beijing brought in. Evergrande which is Chinas second-biggest property developer sparked alarm on global financial markets when it announced in September that it might not be able to pay its many creditors.

Its founder Xu Jiayin briefly became Chinas wealthiest businessperson in.

Evergrande S Tortuous Restructuring Asset Sales In Focus After Default Averted Reuters

Evergrande Shares Rise On Report Of Bond Interest Payment Bbc News

China Evergrande Makes Overdue Interest Payment On Dollar Bonds State Media Says Wsj

Teetering Chinese Property Giant Evergrande Makes 83m Payment To Avoid Default For Now Cbc News

China Evergrande Owes 28m For Changchun Land Deal Asia Financial News

Bonitatsherabstufung Evergrande Krise Reisst In China Weitere Immobilienkonzerne Mit Sich Nachricht Finanzen Net

China Evergrande Wires Funds For Bond Coupon Averting Default Fox Business

China Evergrande Rettung China Wird Keine Finanzkrise Riskieren

China Evergrande Lines Up Funds To Pay Interest Avert Default Source Times Of India